Eliminate all the confusion in the application of taxation in schools!

At the end of the session, participants will be able to:

- understand taxation in schools to maximize resources;

- learn strategies for handling tax enforcement for their employees;

- effectively plan to ensure school’s passing in BIR assessment; and

- get updates on the latest BIR issuance.

This session will help the participants arrive at well-informed decisions on efficient tax applications and compliance, and manage BIR assessment and collection.

COURSE OUTLINE:

- Overview and Types of Taxes

- Definition and Nature of Taxation

- What are the Types of Taxes

- Income Taxation

- Value Added Tax

- Real Property Taxation

- Classification of Income Taxes Imposed in Educational Institutions

- Proprietary

- Non-Stock and Non-Profit

- Government

- Trends and Tax Compliance Affecting Educational Institutions

- Understanding Employee Taxes and Statutory Compliance

- Effects of the Implication of Additional De Minimis Benefits

- Possible Effects of the New SSS Benefit Proposal on the Schools

- Updates on Creditable Withholding Tax

- Statutory Compliance on Registration of Books of Account

- Impact of the BIR’s Computerization and Online Filing

- Understanding Employee Taxes and Statutory Compliance

- Sharing of BIR Cases Affecting Schools

- Managing BIR’s Tax Assessment and Collection

- Strategies in Handling Tax Enforcement in Educational Institutions

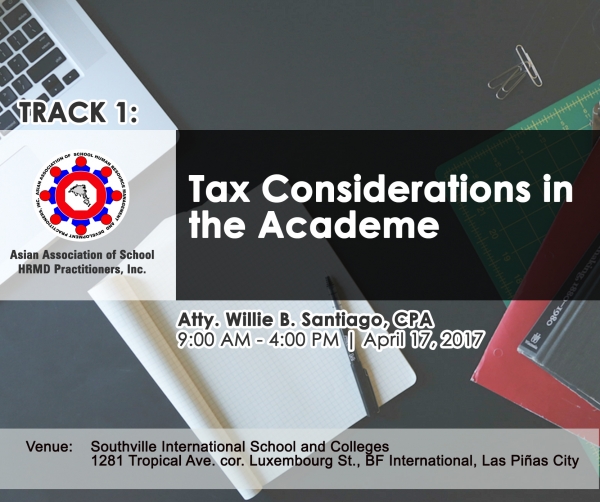

ABOUT THE SPEAKER:

Atty. Willie B. Santiago, CPA is currently the Director – Tax and Corporate Services Division, Diaz Murillo Dalupan and Company. He joined Tax and Corporate Services Division (TACS) of the company in 2006 as Assistant Tax Manager handling contesting tax assessment and tax compliance review engagements. He handled numerous tax assessment engagements involving non-stock-non-profit educational institutions, brokerage, charter flights/airline, other various industries, and service types of business operations ranging from small to medium-size and multi-national companies. also handled personal civil, criminal, and labor cases. He is a member of Philippine Institute of Certified Public Accountants (PICPA), Integrated Bar of the Philippines (IBP) Makati Chapter, and Tax Management Association of the Philippines (TMAP).

|

OTHER TRACKS |

|||

|---|---|---|---|

|

TRACK # |

DATE |

SPEAKERS |

TOPIC |

| Track 2 | April 17, 2017 (9:00 AM - 4:00 PM) |

Dr. Genevieve Ledesma-Tan | Getting the Right People in Schools Through Focused Interview |

| Track 3 | April 18, 2017 (9:00 AM - 4:00 PM) |

Atty. Faustino R. Madriaga, Jr. | Handling difficult Employees through Progressive Discipline and Memo Writing |

| Track 4: SPECIAL TRACK | April 17 & 18, 2017 (9:00 AM - 4:00 PM) |

Mr. Ruel A. Montenegro | An In-Depth Approach in Designing Job Descriptions, Establishing Job Evaluation and Creating Salary Schemes in Schools |

| * Each track is paid separately. These are con-current sessions, each participant can attend one track only for sessions with the same date. | |||

|

SEMINAR INVESTMENT FEE PER SEMINAR |

|

|---|---|

|

|

**Regular/Walk-In |

|

VAT Inclusive |

|

| Track 1 to Track 3 (each track is paid separately) | |

| Member | Php 3,696 |

| Non-Member | Php 4,480 |

| Special Track: Track 4 | |

| Member | Php 6,720 |

| Non-Member | Php 7,840 |

| Cut-off registration and payment | **April 8, 2017 onwards. |

You may download the brochure by clicking here.

|

|

Early bird rate applies until April 7, 2017 only. Don't miss it, hurry and register today!

------------ The Asian Association Committed to Build People and Institutions ------------