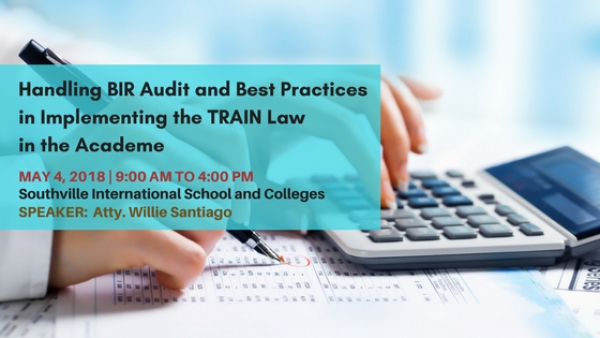

TRACK 3: Handling BIR Audit and Best Practices in Implementing the TRAIN Law in the Academe

Monday, 02 April 2018 01:49

Published in

Learning Session

Have you always been ready for tax assessment? A full understanding of how taxation works is extremely important in making informed decisions about what, when and how to do taxes efficiently. Know the effects of the Tax Reform for Acceleration Inclusion (TRAIN) Law. Learn what was changed and its impact on the academic workforce.

At the end of this session, the participants will be able to:

confidently handle tax audit;

understand the impact of TRAIN Law on the workforce;

learn best practices of tax enforcement; and

update their knowledge through sharing of BIR cases pertinent to school operations.

COURSE OUTLINE:

How to Manage BIR Tax Audit with Ease

Understanding the Classification of Income Taxes Imposed in Educational Institutions

Knowing the Impact of the BIR’s Computerization and Online Filing

Managing BIR’s Tax Assessment and Collection

Strategies in Handling Tax Enforcement in Educational Institutions

Guide on How to Do Self-assessment to Ensure Tax Compliance

What is TRAIN Law

Understanding the Implementing Rules and Regulations (IRR)

What You Need to know about Employees’ Taxes

Identifying the Taxable and Non-Taxable Income of Employees

Treatment of Employees‘ Taxable Income

Compensation Income Earners

Part-time Faculty with Various Employers

Mixed Income Earners

Effects on Employees’ Fringe Benefits

Updates on Withholding Tax

Methods of Filing Income Tax

Knowing How to Manually Compute Withholding Tax: Annualized vs. Monthly

Effects of TRAIN Law in Accounting Administration and How to Manage Them

Best Practices of Tax Enforcement in the Academe

Sharing of BIR Cases Affecting Schools

SEMINAR INVESTMENT FEE

*Group Rate

Regular Rate

Walk-In Rate

Member

Php 2,000.00

(per pax/session)

Php 2,500.00

(per pax/session)

Php 3,000.00

(per pax/session)

Non-Member

Php 3,500.00

(per pax/session)

Php 4,000.00

(per pax/session)

Php 4,500.00

(per pax/session)

Cut-off of registration and payment

Strictly up to April 20, 2018 only

From April 21, 2018 onwards

*GROUP RATE applies to school that will be sending four (4) or more representatives; strictly applicable for those who will settle registration and payment on or before April 20, 2018. For group registrations from April 21, 2018 onwards, REGULAR RATE shall be the reference of payment.

REGISTER THROUGH THESE BUTTONS

DOWNLOAD HERE REGISTER ONLINE

FOR MORE INFORMATION ABOUT OTHER TRACKS

CLICK HERE

Tagged under